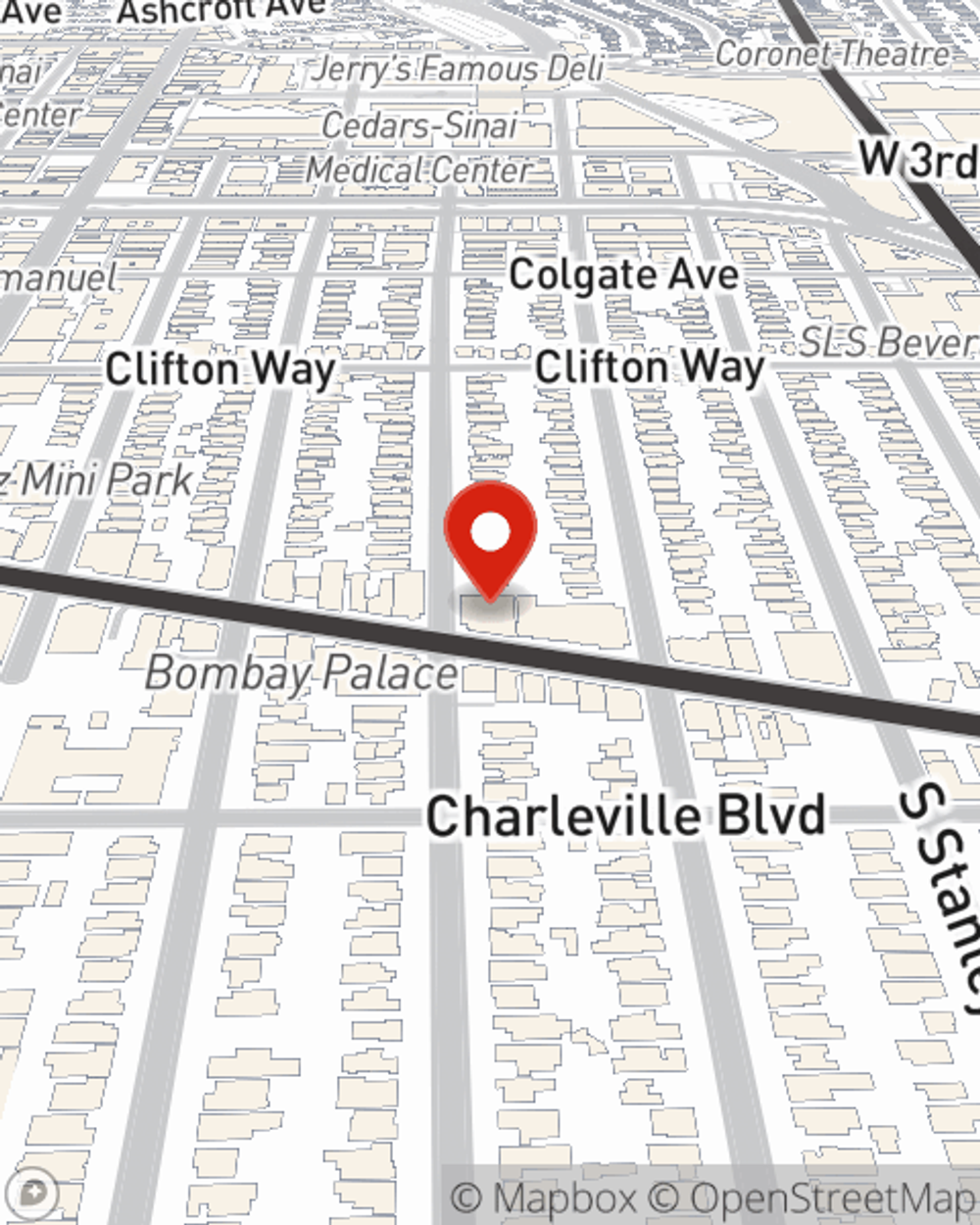

Renters Insurance in and around Beverly Hills

Looking for renters insurance in Beverly Hills?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Beverly Hills, CA

- Los Angeles, CA

- West Hollywood

- Santa Monica, CA

- Brentwood, CA

- West Los Angeles, CA

- Westwood

- Beverly Grove

- Hollywood

- DTLA

- Bel Air

- Encino

- Sherman Oaks

- Calabasas

- Pasadena

- San Diego

- San Francisco

- Henderson, NV

- Las Vegas, NV

- Phoenix, AZ

- Scottsdale, AZ

- California

- Nevada

- Arizona

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented property or townhouse, renters insurance can be the right next step to protect your stuff, including your smartphone, tools, coffee maker, bicycle, and more.

Looking for renters insurance in Beverly Hills?

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

When renting makes the most sense for you, State Farm can help shield what you do own. State Farm agent Afshin Cohen can help you create a policy for when the unanticipated, like a water leak or an accident, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Beverly Hills renters, are you ready to discover the benefits of a State Farm renters policy? Get in touch with State Farm Agent Afshin Cohen today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Afshin at (310) 858-9700 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Afshin Cohen

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.